Exclusive A global payments acceptance platform, Beam, is combining mobile phones and blockchain technology to provide a way of providing that ease-of-use and speed necessary for retail payments. And the company believes the time is right to introduce an alternate mobile payments solution.

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

| Tags |

|---|

Your new post is loading... Your new post is loading...

Your new post is loading... Your new post is loading...

With more than 1500 cryptocurrencies on CoinMarketCap, you have a really wide range of coins to diversify your investments. Some of the coins are on the market for a long time and still have a major potential for growth. For instance, Ethereum has gained about 300 000% in value since the ICO in 2014, and … Continue reading Five New Cryptocurrencies to Diversify Your Portfolio in 2018 Via Kenneth Carnesi,JD

Richard Platt's insight:

Crypterium (CRPT) Crypterium is not the first crypto banking project out there, but it stands out as one of the top 50 most promising fintech companies, according to Financial IT and is backed by Keith Teare, co-founder of TechCrunch. The project team aims to create a global blockchain-based ecosystem where every transaction will be controlled with an easy-to-use e-wallet. It’s like having your bank in your pocket with immediate access to transfers, loans, and most importantly, instant contactless payments in crypto or fiat currency with no need for exchanges. It is also expected to be absolutely free for users, while commissions for merchants are set at 0,5%. Coinlancer (CL) The blockchain-based online freelancing market addresses plenty of current issues faced by freelancers and their clients, from delayed or failed payments to unreasonable account suspensions. Using blockchain, smart contracts, and digital signatures, Coinlancer has it all to make the freelancing market safe and trusted. The Coinlancer coin will be used for all the payments on the platform. Its potential market cap is limited and can’t be compared to the prospects of major cryptocurrencies, but the practical use case is clear and anticipated enough to make the coin a success. DMarket Coin (DMC) Cosmetic items from certain video games can be bought or sold on Steam or other platforms, but DMarket plans to turn the ill-organized trading into a new cluster of the global economy. The blockchain-based marketplace makes it possible for gamers to prove ownership of in-game items and buy, sell, or exchange them in one click without any risk of fraud. DMarket has ambitions to integrate plenty of different virtual universes into a global market, and the agreement with several important video game publishers is already in place. The full launch of the platform is planned for Q1 2018, and the value of the coin is likely to surge soon after that. But the platform is already functioning as a marketplace – you can trade memorabilia items, called DMarket Founder’s Marks, there. The price of Founder’s Marks has already surged from a few cents to more than $100, confirming that the project is of great interest to the gaming community. LOCIcoin (LOCI) The most intriguing feature of the Loci platform is the InnVenn tool for searching and discovering patents. It leverages blockchain technology to offer inventors a simple, cost-effective, and secure way to monetize their ideas as a better alternative to traditional patent process. LOCIcoin is used for buying and selling the intellectual property on the platform. You can also buy an InnVenn subscription for 100 LOCI instead of paying the normal price of $249 per month. Electroneum (ETN) This coin is quite an exception to the list, as it doesn’t have a real innovation or an all-star team behind. It’s just another cryptocurrency intended to provide secure and private digital payment solution and focused on app-based mobile mining. But the project team managed to build hype around their product, conducting a highly successful ICO with 120,000 contributors and creating a strong community with more than 800,000 registered users on the platform. This is a good sign given that real-world mass adoption is the main target of Electroneum. The guys are definitely good at marketing, as well as negotiating with global mobile networks. Although the long-term prospects of ETN are questionable, the project looks capable of maintaining the hype throughout the year, especially since a full launch of the mobile miner is planned for Q1 2018.

Dr David Brown's latest company is called Healx and it's using machine learning to see how existing drugs can be used to treat rare diseases.

Richard Platt's insight:

Dr. David Brown, Healx's chief scientific officer, founded Healx in 2014 with Cambridge University professor Dr Andreas Bender and Dr Tim Guilliams, who completed a PhD at Cambridge in biophysical neuroscience before becoming an entrepreneur. Brown initially developed viagra to treat heart patients but it soon became apparent that it could be used for other purposes. That's essentially what he's trying to do now. Except this time, he wants to find out which existing drugs can be used to treat rare diseases (without too much tweaking). To do this, Healx has developed a platform called HealNet, which the company describes as one of the world's most extensive knowledge bases for diseases. It's said to contain over a billion unique data points that connect diseases, patients and drugs. HealNet uses machine learning to find new uses for existing drugs. The aim is Healnet will lead to automated, large-scale drug discovery.

A number of companies are working on smart contract templates that businesses can easily adapt for their own needs.

Richard Platt's insight:

Smart contracts are computer programs built on a blockchain -- most often, on the infrastructure created by Ethereum. While cryptocurrencies simply tell users that an address has received a particular value, a smart contract takes that confirmation and then performs a series of actions as a result. It might issue a receipt, release a password or do anything else that can be written into the code. The blockchain, with its security and reliability, makes sure that a transaction has happened and can’t be changed. The code automates the next steps in that transaction. Even for small businesses, that automation can make life a great deal easier. Escrow is a service worth billions of dollars; real estate escrow services, for example, charge as much as 1-2% of the value of a property to hold onto purchase funds until a deal’s conditions have been met. Those services can easily be replaced by smart contracts. A property buyer would purchase tokens and send them to an address on the blockchain. The funds stay at that address until a computer program acknowledges that all the required steps in the purchase process have been completed: entering a code on a title deed, for example, or uploading a house inspection certificate or a signed copy of the contract. Once the transaction has met all its requirements, the tokens would automatically be released to the seller, who could convert them back into fiat currency. The entire purchase process becomes automated. For dealers who want the added security of a third party, smart contracts can also be multisignature. Some businesses are already delivering their services through a blockchain. Slock, for example, is using the blockchain to simplify and broaden the sharing economy. It’s creating a blockchain-connected lock that can be attached to any device: a bike, a car or an apartment, for example. Once a transaction has been confirmed on the blockchain, a user can unlock the device and use that object. For renters using Airbnb, or for firms running city-bike schemes, it’s a very simple way to manage rentals. The company is already working on a smart contract-based system to simplify the charging of electric vehicles, as well.

There’s more than one way to gain exposure to blockchain innovation. Beyond buying over-the-counter products or investing directly in blockchain startups some of the largest public companies in the world are already dabbling in the tech. In fact, a closer look at this year’s Forbes Global 2000 list of the largest public companies in the…

Richard Platt's insight:

There’s more than one way to gain exposure to blockchain innovation. Beyond buying over-the-counter products or investing directly in blockchain startups some of the largest public companies in the world are already dabbling in the tech. In fact, a closer look at this year’s Forbes Global 2000 list of the largest public companies in the world reveals that not only are all ten of the largest public companies in the world exploring blockchain, but at least 50 of the biggest names on the list have all made their own mark on technology first inspired by bitcoin.

There is a destructive myth that the ‘creative genius’ is born with an innate, godlike ability to create extraordinary work at the snap of their finger. This couldn’t be further from the truth.

Richard Platt's insight:

TakeawayUnlocking your inner creative genius can be achieved by following these steps:

And most importantly, be patient with yourself. It may take many years to see the rewards of your hard-work — your moments of creative genius will soon show up at the right time.

The British Food Standard Agency has completed a pilot using blockchain in the food sector to enable compliance and transparency in the food supply chain.

Richard Platt's insight:

UK food regulator the Food Standard Agency (FSA) has successfully accomplished a pilot using blockchain technology according to an announcement published July 2. This was reportedly the first time blockchain has been used as a regulatory tool to ensure compliance in the food sector. The pilot was implemented in a cattle slaughterhouse, where both the FSA and the slaughterhouse were authorized to access data in order to improve transparency in the food supply chain. In July, the agency is looking to launch another pilot, which will allow farmers to access data about animals from their farm. Sian Thomas, Head of Information Management, said:

In the future, the FSA states that they will attempt to replicate the program in other plants. The agency said that in order for blockchain to be permanently implemented, it must be an industry-led initiative, as the current data model is used only for the collection and communication of inspection results.

From

www

Orlando's airport is the first in the nation to expand automated facial recognition technology to all international travelers, which means about 5.9 million faces a year will go on record with the US government.

Richard Platt's insight:

Orlando's airport is the first in the nation to expand automated facial recognition technology to all international travelers, which means about 5.9 million faces a year will go on record with the US government. Orlando International Airport, the busiest in Florida, has been testing the system with flights mostly to and from London's Gatwick Airport, airport spokesman Rod Johnson said. Airports in Atlanta, New York and Miami and other cities are in the testing phase now. Orlando's system is expected to be fully operational by the end of this year, Johnson said. US Customs and Border Protection said the technology is 99% accurate and helps to thwart terrorism. Airport officials said it cuts plane loading time by eliminating the need to present a boarding pass. The American Civil Liberties Union objects to the facial recognition data collection and use, saying it's not reliable across gender and race and can be misused to monitor citizens' activities beyond the airport. Customs and Border Protection said it is confident the biometric system will heighten security without infringing on anyone's privacy.

When is Blockchain right for Business? Via TechinBiz

Richard Platt's insight:

While blockchain enthusiasts project the technology will account for 10% of global GDP by 2025, skeptics and supporters alike lack the tools to assess the political, security and environmental implications of the technology and digital currencies. When is blockchain right for business?

In a patent filed with China’s State Intellectual Property Office, ICBC described an idea for using blockchain technology to verify digital certificates using a blockchain, instead of a trusted cen…

Richard Platt's insight:

1st Place - In a patent filed with China’s State Intellectual Property Office, ICBC described an idea for using blockchain technology to verify digital certificates using a blockchain, instead of a trusted central authority, according to a CoinDesk report. While nothing else has been publicly revealed about the bank’s mysterious blockchain research, the plans are reminiscent of other blockchain efforts that seek to place stock certificates on a blockchain instead of in the safes of Central Securities Depositories around the world. 2nd Place - Following closely behind ICBC, with what appears to be slightly more advanced public work, is the China Construction Bank Corporation (CCB), which counts $143 billion in sales and total assets of $2.61 trillion. Last September, CCB revealed it was using the IBM Blockchain platform to streamline the way banks and insurance companies jointly sell some of their products. In 3rd place on the Global 2000 is JPMorgan, the largest company in the diversified financial category, with $118 billion in sales and assets valued at $2.7 trillion. In spite of company CEO Jamie Dimon’s vociferous railing against bitcoin itself, his company has emerged as one of the most visible, and committed enterprises to the underlying blockchain technology. After first contributing its own internally developed blockchain platform, Quorum, to the open-source community, JPMorgan has seen interest among users including pharmaceutical giant Pfizer (#44 on the list with $52 billion in sales) and information giant IHS Markit (#1,211 on the list with $3.6 billion in sales).

Latest technical analysis on top 9 cryptocurrencies from an expert trader.

Richard Platt's insight:

The market capitalization of the crypto world has increased by about $25 billion since May 29. The Italian political crisis and the probable escalation of a trade war have attracted investors back into cryptocurrencies. Dan Morehead, founder of Pantera Capital Management believes that Bitcoin has made a bottom for the year. He proposes to buy now when the prices are still low, to benefit from the ensuing rally in the next few months. We have been voicing a similar opinion for the past few days but we believe that the purchases should be staggered to take advantage of the volatility. Bitcoin continues to be the undeniable leader. It sets the direction that is followed by most altcoins. Brad Garlinghouse, CEO of Ripple believes that once the crypto markets mature, they will start differentiating between the digital currencies and the correlation with Bitcoin will reduce. He, however, warned that 99 percent of the virtual currencies in circulation will vanish in about a decade. Only the ones that solve a real problem will remain. There have been a few complains that we don’t mention the fundamentals in our analysis. In technical analysis, we believe that the charts discount all the fundamental news. Hence, we only read the patterns on the chart and try to forecast the probable direction. In the past few months, these patterns have kept us on the right side of the trade and have helped us avoid large losses. We try to avoid trading during major events, due to the uncertainty. Let’s see, what direction are the charts pointing to today. BTC/USD - They believe that Bitcoin is trading in a large range of $6,075.04 to $12,172.43. The strategy to trade such a large range is to buy near the bottom and sell close to the top. So, we have been waiting to buy on a sharp dip below $7,000, as close to the bottom of the range as possible, so that our risk is less. If the $6,075.04 level breaks, the digital currency can fall to $5,450 levels.

Cryptocurrency hardware wallet manufacturer Tangem has begun the first rollout of its ‘Bitcoin banknotes’ to its pioneer market of Singapore.

Richard Platt's insight:

Cryptocurrency hardware wallet manufacturer Tangem has begun the first rollout of its ‘Bitcoin banknotes’ to its pioneer market of Singapore. Tangem, which seeks to make cash-like transactions using cryptocurrency more familiar to entry-level consumers, plans to mass produce the notes in their “millions” by the end of 2018. In Singapore, a jurisdiction famous for its encouraging regulatory stanceon both cryptocurrency and blockchain technology, the notes will be on sale at the Suntec City branch of design store chain Megafash Coming in denominations of 0.01 and 0.05 BTC ($92 and $463 respectively), the ‘notes’ are in fact banknote-like hardware wallets using technology from Samsung, Tangem claiming their cost makes them cheap enough to use like actual cash.

From

bcfocus

Samsung Electronics Co. Ltd. recently announced its 1Q18 earnings results. The flagship company of the Samsung Group, Samsung Electronics has a division in 80 countries.

Richard Platt's insight:

Samsung Electronics Co. Ltd. recently announced its 1Q18 earnings results. The flagship company of the Samsung Group, Samsung Electronics has a division in 80 countries. In just the first quarter of the year, the company earned 60.56 trillion won, with an operating profit of 15.64 trillion won, a 58% increase as compared to the 9.9 trillion won achieved during the same period last year. What is interesting to note is that it is the semiconductor division that is largely responsible for this phenomenon. As said by Samsung, “the semiconductor division…accounted for about three-quarters (73%) of total operating profits, leading the company to a record high. Demand for the semiconductor division increased due to sales of system LSIs [ASICs] for flagship smartphones and demand for virtual currency mining chips.” The manufacture of the ASIC chips used for mining was confirmed by Samsung in January. According to a Trendforce study published in November, Samsung Electronics is competing with a few other chipset manufacturers like Taiwan’s TSMC, which supplies mining chips to mining hardware makers such as Bitmain and Canaan, and holds a 55.9% market share by revenue in the semiconductor foundry business, followed by Global Foundries with 9.4% market share, UMC with 8.5%. Samsung held 7.7% market share. |

The U.S. Patent and Trademark Office officially published a series of 39 newly granted patents for Apple Inc. today. In this particular report we cover two patents. The first covers the original work done on facial recognition to be used to unlock an electronic device. The second covers the Smart Keyboard's Smart Connector. We wrap up this week's granted patent report wit Via Kenneth Carnesi,JD

Richard Platt's insight:

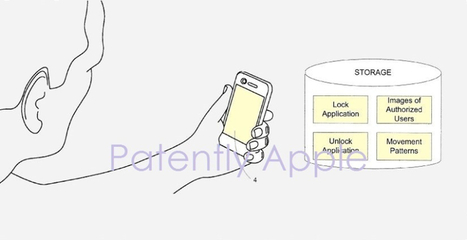

The U.S. Patent and Trademark Office officially published a series of 39 newly granted patents for Apple Inc. In this particular report we cover two patents. The first covers the original work done on facial recognition to be used to unlock an electronic device. The second covers the Smart Keyboard's Smart Connector. We wrap up this week's granted patent report with our traditional listing of the remaining granted patents that were issued to Apple today.

Granted Patent: Locking and Unlocking a Mobile Device using Facial Recognition

Apple's newly granted patent covers their invention relating to a built-in camera captures one or more images, and the images are then analyzed to determine whether a user's face is present therein. If a user's face is not present in the images captured over a predetermined amount of time, the device automatically locks.

While Apple's iPhone X Face ID is far more advanced than their original patent that was filed back in 2011 and published in 2012, it laid a foundation of work towards the final authentication feature that departed from their long standing Touch ID.

Apple's granted patent 9,875,349 was originally filed in 2011 and updated in March 2017.

Granted Patent: iPad Pro Smart Keyboard Connector

Apple's newly granted patent covers their invention relating to the smart connector system used to connect their smart keyboard to the iPad Pro. Apple notes in their granted patent: "the host device may be connected to an accessory device in order to share data, power, or both.

Apple further noted that "Embodiments of the present invention may provide contact structures for devices, where contacts in the contact structures may provide a sufficient normal force to provide a good electrical connection with corresponding contacts while consuming a minimal amount of surface area, depth, and volume in a device, and where the contact structures may prevent or limit the ingress of fluid or debris into the device."

Hedera Hashgraph derives its name from an algorithm. It is based on the “hashgraph consensus” technology that gets around the big trade-off related to blockchain, the fundamental technology behind cryptocurrency. Blockchain can be fast but unsecure, or secure and slow. Hedera Hashgraph aims to build…

Richard Platt's insight:

This is not a riveting topic for many people, but it may surprise you to learn the company has just raised $100 million. It raised the money via a future token sale from institutional investors, and Hedera will use the money to create a new commerce network based on its “hashgraph consensus” technology. Hedera Hashgraph derives its name from an algorithm. It is based on the “hashgraph consensus” technology that gets around the big trade-off related to blockchain, the fundamental technology behind cryptocurrency. Blockchain can be fast but unsecure, or secure and slow. Hedera Hashgraph aims to build a fast and secure blockchain alternative. Mance Harmon, CEO of the Dallas, Texas-based company, will use the money to build out the Hashgraph network and set up a micropayment system that uses the core tech. Put simply, the company hopes to disrupt the world’s financial systems, Harmon said in an interview with VentureBeat this week. “As a technology, it’s a fundamental advance in the world of distributed systems,” Harmon said in an interview with VentureBeat. “It has fantastic performance, and it achieves the best in security one can have in the field.” He added, “Small systems have achieved this in the past, but never at scale. Bitcoin had terrible performance, but it is reasonably secure. It was always a trade-off. What hashgraph does for the first time is break that trade-off, maximizing both security and performance.”

In its latest move against cryptocurrencies, Google announced its plans to remove all bitcoin and cryptocurrency mining apps from the Play Store.

Richard Platt's insight:

In its latest move against cryptocurrencies, Google announced its plans to remove all bitcoin and cryptocurrency mining apps from the Play Store. The decision comes just months after banning Chrome extensions that mine cryptocurrency. Google announced the decision to ban crypto-mining apps on the Play Store’s developer policy page, saying, “We don’t allow apps that mine cryptocurrency on devices. We permit apps that remotely manage the mining of cryptocurrency.” Although users can no longer mine directly from their devices, Google is still allowing developers to release applications that allow mining to be done elsewhere, like on cloud-based computer platforms. Popularity of Cryptocurrency MiningThe popularity of cryptocurrency mining surged in late 2017 during the bull run in the crypto markets. Sales of GPUs skyrocketed to a point where GPU producers, like Nvidia, saw price surges in their stock due to higher than normal earnings. The process of mining uses up a significant amount of computing power, and the profitability is directly related the amount of processing power a miner can contribute. Access to highly profitable mining rigs is limited due to the tremendous expenses that stem from sizable equipment and electricity costs. The decision to ban mining extensions from Chrome and mining apps from the Play Store is likely due to the risks they can pose to a device. Both phones and computers can suffer from internal damage due to mining if it is not properly managed. The risks of mining are highlighted by the effects of mining malware that has been circling through public Wi-Fi networks and websites over the past year. Kaspersky Lab, a Russian security firm, recently reported the effects of merely two days of Monero mining on a laptop. They reported that the internals of the device showed physical damage, including a swollen battery that damaged the exterior shell of the laptop. Not Google’s First Move Against CryptocurrenciesIn March, CNBC reported that Google was placing a ban on all cryptocurrency-related advertisements on its platform. The ban was similar in structure to the bans placed on crypto advertising by social media giants Twitter and Facebook. The ban was implemented with the goal of reducing the number of scams promoted through Google’s search platform, but it also prohibited legitimate businesses, like Coinbase and Binance, from running ads. Google’s director of sustainable ads, Scott Spencer, spoke to CNBC regarding the decision, saying: “We don’t have a crystal ball to know where the future is going to go with cryptocurrencies, but we’ve seen enough consumer harm or potential for consumer harm that it’s an area that we want to approach with extreme caution.” Less than one month after banning cryptocurrency ads, Google announced that they would no longer accept Chrome extensions that mine cryptocurrency. Google announced the decision on their blog, saying: “Starting today, Chrome Web Store will no longer accept extensions that mine cryptocurrency. Existing extensions that mine cryptocurrency will be delisted from the Chrome Web Store in late June. Extensions with blockchain-related purposes other than mining will continue to be permitted in the Web Store.”

Blockchain technology has enormous potential, but it doesn't have the ability to scale just yet.

Richard Platt's insight:

Why isn't Blockchain ready for scale - By example take Bitcoin -- which records all transactions on a blockchain. The computational energy required to post a single blockchain transaction is enough to power the average U.S. household for a week. The beauty of blockchain is that trust is replaced with consensus. Consensus requires every single node in the blockchain network to agree the transaction is correct. The Bitcoin blockchain can currently support only seven transactions per second (tps). For comparison, the PayPal network can support 193 tps and the Visa network can support more than 1,600 tps. Clearly, we have a long way to go. This is why we don’t see people paying for pizza with bitcoin. It's used more as a store of value. So What’s The Solution? The potential of using blockchain technology is monumental -- so is the value in solving its scale challenges. This is why I think we’ll see existing technology companies find ways to offer blockchain solutions to customers while shouldering the challenges with computational scale themselves. Within the coming year, we’ll see software vendors in various industries chip away at scale issues by starting with their own limited customer base. Managing blockchain will become a natural part of what software providers do, down to installing software on servers and containers that make the technology function. In finance, this is likely to be blockchain that helps companies manage their sub-ledgers. In trading, we’re likely to see products that record the entire activity of given stock markets without the need for a Bloomberg Terminal integration. In health care, we’re likely to see more efficient ways of managing patient records securely. These are the smaller ways we’ll see blockchain change our lives before the technology truly reaches a scale that we can consider revolutionary.

Richard Platt's insight:

Bill Gates recently invested $750 million for a majority share in an automated trading software called Bitcoin Trader. The founder of Microsoft expects to double his investment in 6 months. This is thanks to the Bitcoin boom and Microsoft's huge database of machine learning. Mr. Gates believes in financial freedom for all. Although his ideas seem crazy to many, Bill is proving them wrong year after year. He has been using his wealth to make the world a healthier and happier place. Bitcoin Trader is his latest project. 'I want people to reach financial independence. They shouldn't be slaves of economic booms and depressions', Gates announced in a TEDx talk. That's why he acquired Bitcoin Trader. What exactly is Bitcoin Trader? It's a financial technology with a plan to redistribute the world's wealth. It takes from the top 0.1% and gives back to 99.9%. Bill Gates believes wealth is not spread out enough for a good future. Yes, there always will be a rich class but the current situation is not acceptable. It can lead to great social issues in the future. Today, the top 0.1% controls almost 90% of world wealth. Gates believes he can cut that down to 20%. So how does this affect regular working people like us? This means you will become 2 - 3 times wealthier, and no one except the super-wealthy will take a hit. Sounds amazing, doesn't it? How does it work? Simple! The richest top 0.1% in the world keep their wealth invested in assets.Wall Street traders trade these assets for them. Bitcoin Trader beats the Wall Street traders at their own game. Bitcoin Trader wins so many trades that Wall Street loses a lot of money over time. To do this you need better asset prediction than Wall Street. That is where Bitcoin comes in. With the help of a huge machine learning cloud and the volatile Bitcoin price, it's actually already happening! The more often the price of Bitcoin changes, the more chances it has to grab profits from Wall Street. This is why Gates jumped on this technology as soon as he heard about it. It's revolutionary.

Cryptocurrency mining profits are on the way down, resulting in declining demand for mining hardware, with sources expecting a 20% price cut for GPUs. Via Lionel Gikonyo

Richard Platt's insight:

Cryptocurrency mining profits are on the way down, resulting in declining demand for hardware, such as high-end graphics cards. Sources suggest that GPUs could drop by as much as 20% within the upcoming month.

Lionel Gikonyo's curator insight,

July 4, 2018 6:15 AM

"Cryptocurrency mining profits are on the way down, resulting in declining demand for hardware, such as high-end graphics cards. Sources suggest that GPUs could drop by as much as 20% within the upcoming month."

I am sure that you have heard of one of the only profitable FinTech unicorns in the world: Klarna. A customer making an online purchase enters only their email address and zip code on an e-commerce merchant site to buy an item. Klarna pays that merchant immediately and then collects the amount due from the consume

Richard Platt's insight:

Here is a list of some of the areas in financial services that are seeing major overhauls: Credit Scoring: Undoubtedly, one of the major sectors that has seen unprecedented new solutions leveraging big data is lending and credit scoring. For decades, credit scores provided based on basic financial transaction served as the norm for all credit activities in the financial services space. Essentially, these new sources go beyond the available quantitative data from banks and assess qualitative concepts like – behavior, willingness, ability, etc. The growth in segments such as P2P Lending, SME Financing is a result of these innovative scoring models. Examples of such startups include Credit Sesame, Faircent, OnDeck, Kabbage, LendingClub, Prosper, ZestFinance and Vouch Financial. Customer Acquisition: The cost of acquisition drops drastically for customer acquisition when we compare the physical to digital channels providing huge benefits to both financial services firms as well as startups. Place – one of the four Ps of marketing – has been dominated by the digital channel by both customers and clients. Increasingly, the customers’ behavior to use digital channels coupled with low-cost advantages for clients (especially in financial services) makes this a major focus area. Leveraging big data, financial services are moving to digital channels to acquire customers. The growth in number of offerings which are moving online – direct investment plans, online savings/deposit account opening, automated advisory services – provides a clear indication of the importance of digital channels for financial services. Marketing, Customer Retention, and Loyalty Programs: Contextual and personalized engagements – be it in product/service advertising or discount offerings, have become the norm of many new-age companies. Analytic solutions that combine historic transactional data coupled with external information sources increase the overall conversion rate. Many financial services firms partner/acquire/invest in startups and growth-stage companies, and are actively pursuing these services. Firms are effectively leveraging these solutions to increase the cross-sell and upsell opportunities, understanding customer requirements and providing customized packaging. Card-linked offers, customized reward solutions are some of the offerings that are being provided by FinTech firms. Some solutions in marketing, loyalty and customer acquisition space are Cartera Commerce, Cardlytics, Truaxis (acquired by MasterCard in 2012), Segmint, Personetics, etc. Risk Management: World-over, real-time payments have taken center stage in the past decade and hence, there is a requirement for enhanced risk management solutions in this new environment. Predictive analytics that utilizes device identification, biometrics, behavior analytics, etc. are major driving factors (each solution or a combination of each of them) for better risk management solutions in the fraud and authentication space. Firms that execute well on eradicating vulnerable access points would benefit not only in terms of lower losses but it also increases stickiness to their solutions. Apart from banks’ own initiatives, various regulations are also enforcing rules that make it vital for banks to store and manage more information about payments. Hence, apart from just storing this data, banks look at building powerful algorithms that mine this data and provide actionable insights. Some startup solutions in this space are BillGuard, Centrifuge, Feedzai, Klarna, etc. Investment Management: Investment management as a segment has witnessed innovation on multiple fronts. While robo-advisory solutions take the spotlight in the segment, there are other solutions that are leveraging the power of big-data to provide efficient investment management solutions – the ability to utilize search data, combine multiple macroeconomic factors, quantifying latest news/insights and combining all these to provide potential upside/downside scenarios. Also, there are solutions developed to detect specific market anomalies and provide preventive action steps in the investment portfolio. Specific startup solutions in this space include Wealthfront, EidoSearch, SigFig, Betterment, LearnVest, Personal Capital, Jemstep, etc.

Bitcoin fell to within touching distance of the $6,000 mark on Friday, a figure not seen since February, following improvement orders from Japan's Financial Services Agency (FSA) to six of the country's crypto exchanges.

Richard Platt's insight:

Bitcoin fell to within touching distance of the $6,000 mark on Friday, a figure not seen since February, following improvement orders from Japan’s Financial Services Agency (FSA) to six of the country’s crypto exchanges. Bitcoin Continues to FallThe number one digital currency is seeing its value being chipped away as the integrity of the market continues to be undermined. Yesterday, it was reported that Tokyo-based cryptocurrency exchange and five others had been handed business improvement orders from Japan’s FSA. bitFlyer, Japan’s biggest exchange, said that it was temporarily suspending its new customer account service as it worked with the agency to solve the identified problems. Earlier this week, NewsBTC reported on the hack that took place at South Korean crypto exchange Bithumb. Following a change to the exchange’s wallet service, it was reported that it may have resulted in an unexpected hack. As a result, thieves were able to siphon off with over $30 million worth of cryptocurrencies. A few weeks earlier, fellow South Korean cryptocurrency exchange Coinrail was the victim of a ‘cyber intrusion.’ It’s estimated that 40 billion won, or $37.28 million, worth of cryptocurrencies was stolen. Undoubtedly, these hacks are impacting the reputation of the crypto market, which is being seen across the board in industry prices. At the time of publishing, Bitcoin is trading at $6,098, according to CoinMarketCap, representing a near 10 percent drop in the past 24 hours. Ethereum is down at $467, a fall of 11.31 percent, whereas Bitcoin Cash is down by more than 13 percent.

Beyond Cryptocurrency: Blockchain for the Real World Via TechinBiz

Richard Platt's insight:

This past year has been defined by cryptocurrency. It is the latest trend; the hottest new technology. However, while most are familiar with powerhouses like BitCoin and Ethereum, many users have overlooked the full potential that blockchain technology has to offer.

Tatiana Noemi's comment,

June 15, 2018 6:01 PM

Listen to this podcast , a former president to a credit card company explains why bitcoin is the future of payment : https://newtheory.com/why-now-is-the-best-time-for-you-to-invest-in-cryptocurrencies/

Richard Platt's insight:

Leon Saunders Calvert, Global Head of M&A and Capital Raising at Thomson Reuters explores to what an extent Fintech is now changing the Investment Banking industry.(very short video)

South Korean Samsung Electronics saw its operating profits surge in the first quarter of this year compared to the previous year. The company attributes the increase to its semiconductor division which manufactures bitcoin mining chips and says that it expects the trend to continue into the second quarter.

Samsung, the giant South Korean company of the electronics industry, had a profit surge in the first quarter of 2018 because of crypocurrency mining. The company believes that it is selling conside…

Richard Platt's insight:

The company is a world leader in the production of semiconductor tech, which makes it one of the more popular choices for crypto mining. During the first quarter of 2018, the company earned 60.65 trillion won (about 56 billion USD). Compared to 2017, this was an increase of 58% in sales. The Seoul Newspaper media outlet has reported that semiconductors are accounted for about 73% of the total profits of the company in the quarter Demand for Semiconductors Increase Because of Sales to Create ASIC Miners Semiconductors made by Samsung can be used to create ASIC Miners, which are a common type of mining machines for Bitcoin. The company perceived this trend and started to produce semiconductors that could be used for this purpose this year. This explains the surge in the profits. Halong Mining, which is a very influential mining company, has already stated its flagship product, the powerful Dragonmint T1 Miner, uses Samsung’s chips. The beginning of the year is generally considered a quarter in which the company sells fewer products because the seasonal demand for mobile parts is generally lower, but Samsung was able to make this record number due to the increasing sales of these products. |

Mobile payments are still in their infancy. While Apple Pay and Google Pay continue to grow at a fast pace, only a small percentage of consumers use them in comparison to credit cards and other established retail payment options. So with the competition still yet to take hold, the industry is ripe for disruption through blockchain technology and distributed ledgers, but only as long as that process is made as easy, and as quick, as using the incumbent payment methods. A global payments acceptance platform, Beam, is combining mobile phones and blockchain technology to provide a way of providing that ease-of-use and speed necessary for retail payments. And the company believes the time is right to introduce an alternate mobile payments solution. “There are examples where adoption has been less slow,” Beam cofounder and CEO Serdar Nurmammedov told me. “In China, 90 percent of consumers use WeChat as payment for offline purchases. Take a place like the UAE, where the phone penetration rate is much higher than average at 228 percent, you’ll find higher rates of mobile payment adoption. In Dubai, for example, we have seen consumers willing to pay using their mobile when incentivized to do so. Over there, merchants have managed to eliminate payment processing fees altogether on the Beam network.” So why does this need to exist? What’s wrong with the old way of paying for products in-store?

The current retail economy is rife with inefficiencies. According to studies, $4.5 trillion worth of value is extracted from and wasted in the global retail ecosystem by incumbent intermediaries.