Two scholars measure the economic impact of VC-funded companies.

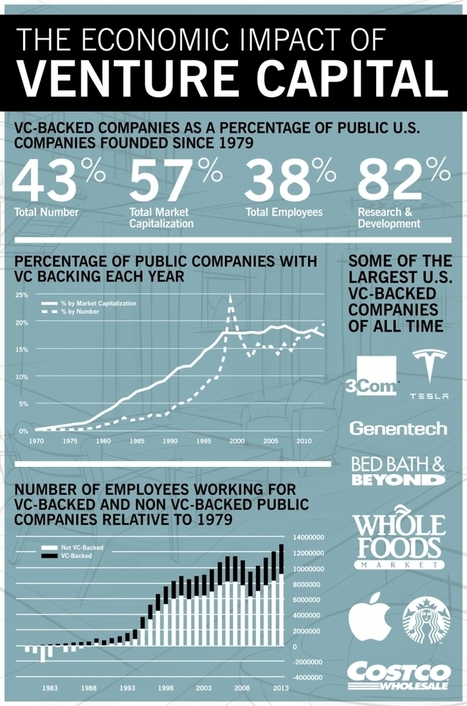

Over the past 30 years, venture capital has become a dominant force in the financing of innovative American companies. From Google to Intel to FedEx, companies supported by venture capital have profoundly changed the U.S. economy. Despite the young age of the venture capital industry, a fifth of current public U.S. companies received venture capital financing.

Venture capital (VC) is a high-touch form of financing that is used primarily by young, innovative, and highly risky companies. Venture capitalists provide not only financing but also mentorship, strategic guidance, network access, and other support. These investments are highly speculative — most of the companies that receive VC funding will fail, even as some become runaway successes. Three out of the five largest companies in the world received most of their early external financing from VC.

Via

Marc Kneepkens

Your new post is loading...

Your new post is loading...

This past year has been defined by cryptocurrency. It is the latest trend; the hottest new technology. However, while most are familiar with powerhouses like BitCoin and Ethereum, many users have overlooked the full potential that blockchain technology has to offer.