When is Blockchain right for Business?

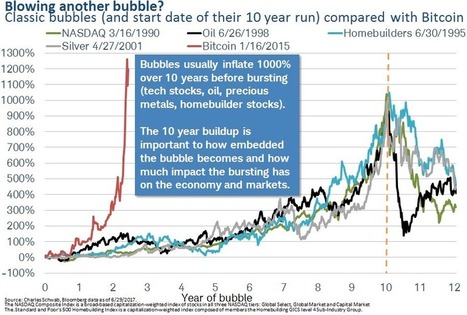

While blockchain enthusiasts project the technology will account for 10% of global GDP by 2025, skeptics and supporters alike lack the tools to assess the political, security and environmental implications of the technology and digital currencies. When is bloc

Via TechinBiz

Your new post is loading...

Your new post is loading...

While blockchain enthusiasts project the technology will account for 10% of global GDP by 2025, skeptics and supporters alike lack the tools to assess the political, security and environmental implications of the technology and digital currencies. When is blockchain right for business?